Avoid taxable gains with 1031 Exchange Delaware Statutory Trust (DSTs 1031)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

10 Benefits of 1031 Delaware Statutory Trust (DST)

Avoid financial obstacles

In a 1031 Exchange transaction, the debt placed or assumed on the replacement property must be equal to or greater than the debt relieved in the relinquished property. Property owners may run into a road block when financing their replacement properties. For example, a property owner may wish to sell an apartment building worth $5 million with $2.5 million in debt, or 50% loan-to-value (LTV). If that property owner cannot get approved for a $2.5 million loan on their replacement property, they most likely won’t sell.

The majority of the 1031 Exchange programs we suggest are structured so that the replacement property is owed by a Delaware statutory trust, or DST. The DST is a pass-through entity that owns the real estate assets. When a replacement property is owned by a DST, the DST will be the borrower of any loan and investors in that DST will not need to be individually qualified with a lender.

DSTs make great back up properties

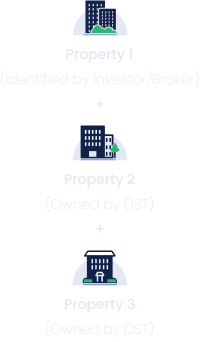

A common strategy to identify replacement properties is the “3 Property Rule,” where an exchanger may identify up to three properties, without regard to their fair market value, within 45 days. Identifying only one property may be dangerous because a property can fall out of escrow for many reasons: financing, inspections, etc. To secure an opportunity to execute a successful 1031 exchange, the exchanger could identify the first property through a real estate broker and identify two additional properties owned by DSTs. Identifying additional properties has no additional cost and helps ensure the exchanger has adequate choices.

Avoid taxable gains on boot

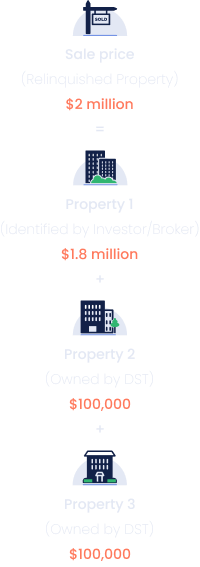

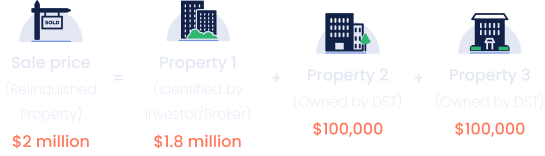

The exact dollar amount of the replacement property is a common challenge in 1031 transactions. In one example, the relinquished property sells for $2.0 million and the exchanger identifies a replacement property for $1.8 million. The difference in the price of the relinquished property and the price of the replacement property results in a taxable amount on the remaining $200,000. Under the “3 Property Rule,” DSTs provide a solution:

No property management headaches

Property is professionally managed by a third party in a DST-structured 1031 Exchange. Professional managers handle the Terrible Ts: Tenants, Toilets, Trash, Turmoil, Termites. The investor enjoys the Terrific Ts: Travel, Time, Tennis. Many DST programs offer additional benefits, including the direct deposit of distributions, if any, and reporting through substitute 1098/1099s.

Diversification benefits

Investing in a DST can provide portfolio diversification. For instance, an investment could be made in a single DST that owns multiple properties in several states. It would be almost impossible for a broker to identify three replacement properties in three different states within the allowed 45-day timeframe. So DSTs are an optimal way to achieve diversification.

Don’t get sidelined

Many realtors have clients that will not sell until they find the “right” property. Having the option to invest in institutional-grade properties owned by professionally managed DSTs may get investors off the sidelines, and the realtor receives their commission.

Swap ‘til you drop

A DST is different than a 721 Exchange (UPREIT) transaction where the investor’s exchange journey ends with the sale of the UPREIT. The DST structure allows the investor to continue to exchange properties over and over again until the investor’s death. Upon the death of the investor, under current tax laws, the heirs would get a “step up” in basis, thereby avoiding capital gains taxes on the original and subsequent properties.

Estate planning tool

Investing in a DST eliminates the opportunity for heirs to argue over what to do with an investment property when the owner passes away. The heirs continue to receive distributions from the investment, if any, and upon the sale of the property owned by the DST, each of the heirs can choose what to do with their inherited portion. One heir can continue to exchange the investment, while another can sell and receive cash proceeds.

Quality properties & leverage options

DSTs 1031 Investments maintains relationships with a broad range of DST sponsors representing diversified properties across the United States, and a wide variety of property types and leverage options. This wide range of opportunities enables investors to select a high-quality, institutional-grade private placement program that best suits their needs.

Low minimums

An investor can exchange as little as $100,000 into a DST. This can include the remaining assets leftover from a property exchange.